Consumer mindset: Decision patterns for the next big purchase

It’s not easy for shoppers to commit to making a big purchase, such as a mattress, major kitchen appliance, or a vacation. Spending a large sum of money can cause stress, second thoughts, and buyer’s remorse.

And many Americans have to save up for months to afford just a few hundred dollars. A LendingTree survey showed that 60 percent of American millennials couldn’t afford a $1,000 emergency expense and, according to the Federal Reserve, 40 percent of Americans struggle to afford a $400 unexpected expense.

Emergencies and unexpected purchases aside, we recently looked into the thought process that goes into making a purchase in that price range, surveying 463 consumers who had made at least one purchase with Affirm in 2018. Understanding this process will help retailers adjust their communications and offerings to make consumers feel more comfortable and convert quicker.

Here are the three biggest takeaways for retailers:

1. The biggest challenges: Deciding how much to pay and making room in the budget.

We all know that anxious feeling when your bank balance shrinks after a large purchase. Deciding how much to pay and making room in the budget were the top issues for consumers in our survey, with 22 percent and 20 percent of respondents, respectively, listing these as the most difficult parts of a purchase. Even though affordability was the main concern for buyers, finding a deal, deciding where to buy, and choosing a brand were all on the shoppers’ minds.

Interestingly, customers with high access to credit have trouble deciding what’s a good deal and are more cautious about their big purchases. Customers with low access to credit have trouble deciding what they can afford, our survey found.

Tip for retailers: Offering a way to pay over time could ease the stress of a large, lump-sum purchase as shoppers will pick payment terms that work for them and their budgets. From our consumer preference investigation, we found that consumer price sensitivity spikes at $150 per month. This is the point where consumers start to select for longer repayment periods to make the monthly burden more manageable.

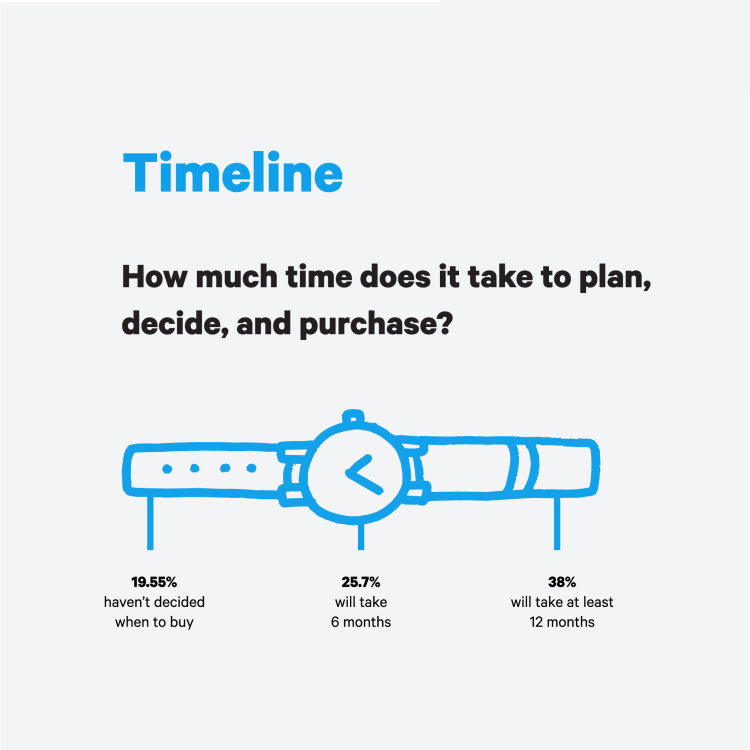

2. The timeline for a big purchase is long and includes many steps.

Our research showed that the process for expensive purchases is complex, multi-faceted, unique for each customer, and tend to take many months of contemplation. Shoppers spend time researching, weighing their options, and checking their guts before they buy. The average shopping journey for an expensive item is between six and 12 months.

During this time:

31 percent of consumers visit a brick-and-mortar store

36 percent set aside money

52 percent select a brand

61 percent create a budget

52 percent choose a payment method

73 percent read reviews

Tip for retailers: Consumers aren’t rushed, so you shouldn’t be, either. Take your time and keep re-engaging interested shoppers for many months or, in some cases, years.

3. For high-ticket purchases, customers plan and shop on multiple devices.

When it comes to expensive items, shoppers aren’t making impulse buys, but they are likely to browse in bursts. These short windows aren’t enough time to completely decide and commit to a large purchase, so the shopping journey is fragmented across multiple devices. For example, shoppers scroll through a few items during commutes on their phones, then look up a review on their desktops during lunch, then check out a couple different brands later that night, before finally checking out.

Mobile and desktop are the most used devices for shopping, with mobile dominating in beauty and apparel purchases for both planning and shopping. Almost 70 percent of apparel and beauty shopping happens on mobile, according to our survey. More expensive items like furniture, travel, luxury, automotive, and electronics are explored and completed equally on both desktop and mobile.

Tip for retailers: Meet your customers where they are, whether that’s on mobile, desktop, in-store, or all three. Your consumers have an omnichannel journey, so your business needs to be omnichannel as well.

These three takeaways should help retailers understand and empathize with the mindset of their customers during a large buy. This knowledge can help businesses create a strategy that is relevant and resonant.

Illustrations by Siena Haz. Research by Colleen Carroll.