Buy now, pay later

for B2B customers

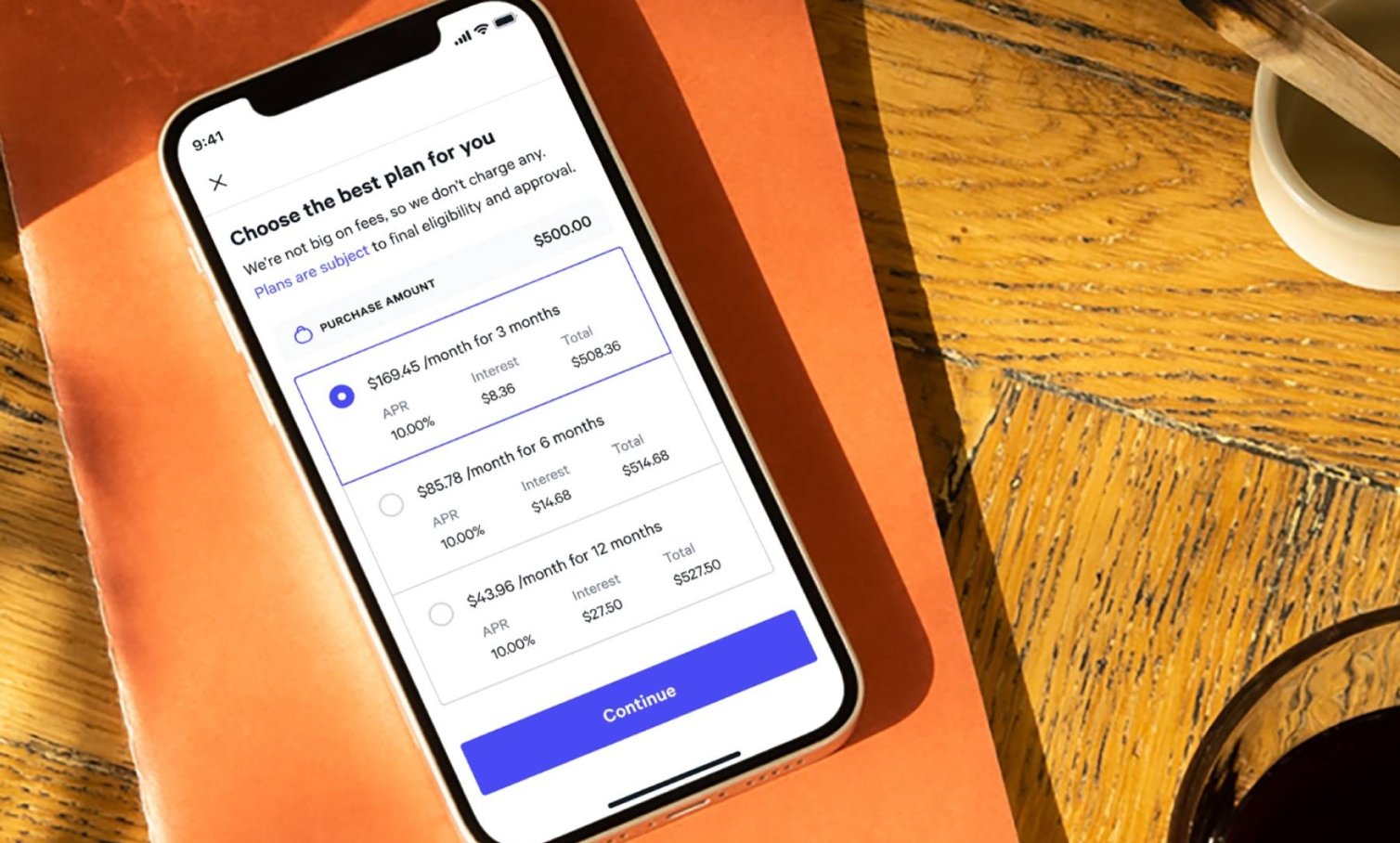

Bring the power of Affirm to your sole proprietor customers. Boost conversion and acquire new customers by providing a pay over time solution that gives instant decisions and fair terms—no late fees or compound interest.

The ease of BNPL, now for business purchases

Boost conversion by offering business owners the flexible financing they need.

Affirm has the first buy now, pay later point of sale offering for eligible small businesses. It offers more flexibility, less friction, and instant decisioning unlike traditional business lending products.

Expand your customer base with smarter payment options for eligible small business customers.

The same industry-leading buy now, pay later experience consumers know and love—now available for sole proprietor customers.

Our machine learning powered underwriting provides flexible payment options for businesses—at every price point.

How it works

Customize your solution

Select payment options that meet your business needs and suit your customers’ budget.

Manage your risk

We help you minimize risks, including fraud and costly chargebacks.

Enjoy seamless transactions

We pay you upfront—within 1–3 business days from purchase.

Getting started is easy

From sign up to launch, integration with Affirm is simple—and we’re here to help.