SwissWatchExpo is making luxury watches more attainable

SwissWatchExpo set out in 2003 to become a trusted retailer of pre-owned luxury watches. By offering supreme, hand-selected products, and a personalized buying experience, the company has built a powerful brand that customers love.

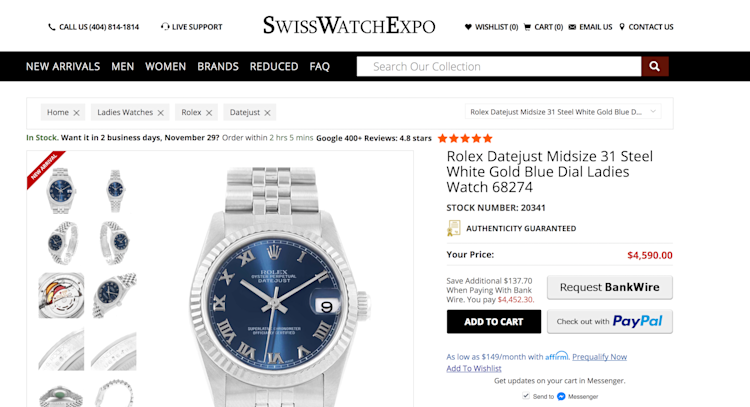

Every watch the company carries has been thoroughly inspected by a team of expert watchmakers, guaranteeing products of the highest quality. For SwissWatchExpo, the buying experience is as important as the products sold: the company extensively photographs all watches so customers know exactly what they’re buying.

SwissWatchExpo was born out of a demand for making pricey items more affordable. By introducing pay-over-time financing—which lets customers receive their watches today, and pay in manageable monthly installments over time—the company is helping even more shoppers to access their curated selection of first-rate watches.

Finding a customer-approved financing solution

The products that SwissWatchExpo resells can cost thousands of dollars, or more, when brand new. Given this price point, even a pre-owned watch purchase can be quite costly. Eugene Tutunikov, SwissWatchExpo CEO, says the company sought financing options in order to ease the financial burden of buying an elegant timepiece.

As a company dedicated to putting the customer’s needs first, finding the right financing partner was crucial. The company surveyed potential partners like Bread and Klarna, but ultimately, weren’t convinced that a partnership with these companies would be mutually beneficial. They landed on Affirm—the honest financing company with a commitment to fair, transparent lending.

Tutunikov preferred Affirm’s unique underwriting model that looks beyond FICO to responsibly approve more customers. Affirm also offers a superior user experience via a simpler application process and by showing customers the full cost upfront without the potential for late or penalty fees. Moreover, the team at SwissWatchExpo was impressed by Affirm’s robust fraud policy, which fully protects merchants from illicit transactions.

Tutunikov also noted that integrating Affirm into their proprietary e-commerce platform was quick and easy. The Affirm team oversaw the process from start to finish—a time period that spanned under two weeks.

Alternative credit boosts product accessibility, drives customer satisfaction

SwissWatchExpo soon found that shoppers were quick to take advantage of the option to pay over time. Since launching, Affirm currently accounts for 17 percent of SwissWatchExpo’s total sales. Once they introduced the option to pay over 24 months, the company’s average daily volume with Affirm shot up to 52 percent. Tutunikov estimates that, had the option to pay over time not been offered, around two-thirds of Affirm shoppers may not have ever converted.

Beyond encouraging conversions, the introduction of Affirm has created a happier customer base. SwissWatchExpo shoppers are thrilled to no longer have to wait months to save up the cash for a watch, or settle for a lower-quality model due to cost. Tutunikov says customers frequently call in to voice their appreciation for Affirm’s alternative credit options.

Since observing Affirm’s popularity and impact, the SwissWatchExpo team has made it a priority to draw further awareness to Affirm, creating promotional emails and sales pushes that center around the option to pay over time. As a high price point is often a key conversion hindrance, Affirm has been a particularly powerful tool in targeting cart abandoners.

“A $5,000 watch might seem like a big headline number for a luxury good purchase,” Tutunikov explains. “But when customers see $200 a month—for a lot of people, that’s a lot more manageable.”

By allowing shoppers to spread out their payments, Affirm is helping SwissWatchExpo reach new consumers, who are quick to take advantage of a trustworthy credit option. It is a true win-win: customers are able to better budget for the products they want and need, and SwissWatchExpo is seeing the bottom-line results.

Says Tutunikov, “Using Affirm is just smarter. As consumers get more educated, more and more folks will checkout with Affirm over credit cards.”