Suiteness is expanding customer markets with Affirm

Goal: Grow customer market and increased conversions.

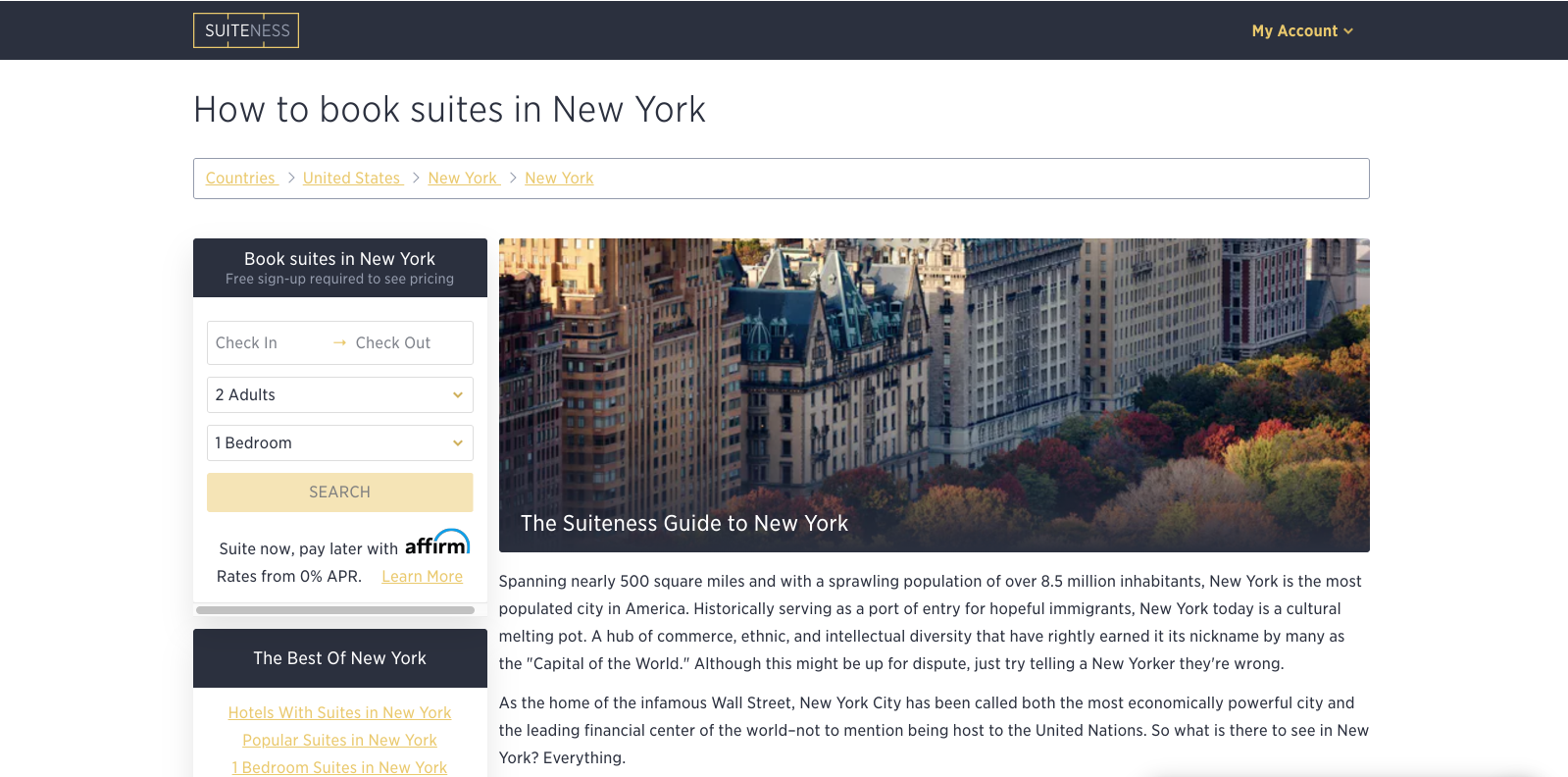

For families or those traveling as a group, booking a house or large apartment is normally seen as the only option. Suiteness wants to change that. They offer another option, one that comes with access to luxurious amenities like private entrances, personal butlers, and private pools: hotel suites.

According to co-founder Kyle Killion, many of these suites are not normally offered directly to consumers, either due to the inability of hotels’ booking systems or their exclusivity, like being reserved for upgrades. But now, Suiteness is the only place online people can gain direct access to these premier suites. Offering customers a simple way to finance their suites was important to Suiteness, said Killion. They soon decided to offer Affirm because of its commitment to offer fair and honest financing to consumers, and it aligned well with the Suiteness brand.

“Brand awareness for Affirm is growing,” said Killion, “and it helped our customers be comfortable with this [payment] option.”

Suiteness had two goals in mind when considering a financing option. First, they wanted to make it easier for people booking suites to pay for their rooms at the time of purchase.

Leveraging payments to create a better customer experience

Normally, when booking a hotel room directly through the hotel or via an aggregator site, customers are only paying a down payment at the point of sale. When they arrive at the hotel, they’re asked to pay the remaining balance. This causes confusion for customers who believe they already paid the full amount, but it also creates issues for hotels because it can lead to an increase of no shows for customers that understand they haven’t paid the full amount.

Killion also believed that financing would be a good fit for the hotel and travel industry because people typically book trips months in advance. So, offering them the option to pay for 3, 6, or 12 months would align with this intended goal to collect payment before the customer ever set foot in their suite.

Suiteness integrated Affirm into their custom e-commerce platform, a process Killion described as simple and that “only took a couple of days.” They also decided to offer a 0% APR promotion to all customers choosing to pay with Affirm to encourage adoption. They soon began seeing the benefits they were hoping for, and some they weren’t expecting. “There are two unique attributes for Affirm customers,” said Killion. “They do skew younger and, secondarily, they do skew mobile.”

Additionally, Suiteness wanted a financing option that would help grow their customer market. Their typical customers are in their 30’s and high earners but often have limited, available credit. They hoped that by offering an alternative financing option for consumers to pay for their suites in simple and transparent monthly payments that it would lead to these customers converting at higher rates.

Top line growth that’s informing business initiatives

Since launching, Suiteness has seen a 41% increase in 18-24 year-old customers buying with Affirm versus their other payment options. While they have been successful in meeting their intended goal of converting their core customer, the fact that they’ve been able to attract a younger audience is significant. This is especially true considering hotel suites aren’t always cheap, so drawing in a younger customer market is key to growing their business.

Another benefit is that Affirm is boosting engagement on mobile devices. 57% of Affirm users are checking out on mobile compared to only 28% of users through their other payment methods. Affirm’s payment process is mobile optimized, making it simpler for customers to follow through with their purchase on their mobile devices—only five pieces of information are needed and it’s seamless with the retailer’s existing checkout flow. Killion agreed, “It’s much easier to checkout on mobile with Affirm.”

Ultimately, while Affirm is making direct impacts to their top line, it’s also helping Suiteness have a better understanding of their customer base and is informing their business decisions. Unlike credit card companies, Affirm offers retailers financial demographic data. “What’s interesting for us,” Killion said, “is that we’re getting better financial demographic data than we are through other channels like credit cards. It does help us with our marketing profiles.”The bottom line is that Affirm is not only creating a better experience for their customers, but it’s also creating real results for Suiteness.