Jomashop is boosting revenue by addressing customers’ needs

Goal: Expand customer markets and increase conversions.

Jomashop has been in the retail and wholesale trade of luxury goods, including high-end watches, fine writing instruments, handbags, fashion accessories, crystal, and gift items for nearly 30 years.

But it is watches – thousands upon thousands of watches – ranging in price from $100 to $70,000, that dominate the New York company’s business. General Manager Osher Karnowsky says Jomashop has somewhere between 18,000 and 22,000 different watches offered online on any given day – “plus or minus one or two,” he quips with a smile.

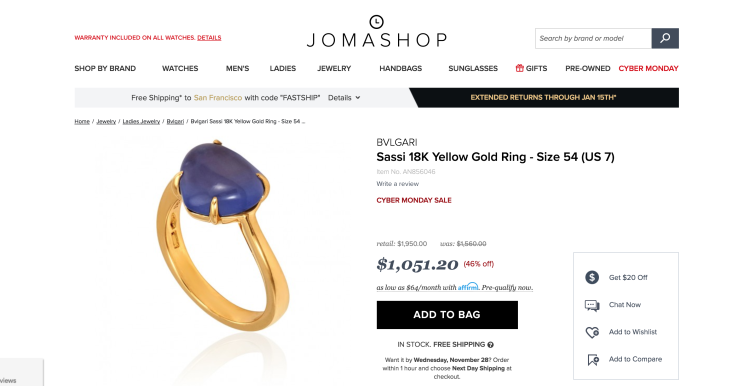

Jomashop’s sales have consistently skyrocketed year-over-year, earning the company a coveted ranking of 149 in Internet Retailer’s 2017 Top 500 Guide. One of the key factors influencing this growth is Affirm payments. Jomashop began offering Affirm as a solution to help shoppers purchase the luxury goods they love and pay for them over time in a way that best fit their monthly budgets.

The results needed to be seen to be believed

The impact from offering Affirm has been remarkable. Average order values (AOV) have increased by 210 percent, and sales conversion rates have improved by 7 percent due to Affirm. It’s also affecting customer loyalty by opening the door to a better customer — 34% of those who pay with Affirm repeat purchase.

Before integrating Affirm, Jomashop offered all the standard payment methods: credit, debit, PayPal. Even Checkout by Amazon. And in general, they worked fine. “They were meeting our needs,” says Karnowsky. “But Affirm meets a different need. With Affirm, there’s suddenly a tremendous opportunity for customers to buy something they really want, but can’t lay out all the money for at once. For them, paying over several months at reasonable interest rates is very attractive and has been a great success.”

Affirm is empowering the entire purchase funnel

Karnowsky says Jomashop had been looking for the right payment partner for some time. But it was Affirm’s simplicity, transparency and honesty, says Karnowsky, that won the day. Affirm’s robust underwriting process is designed to prevent shoppers from purchasing more than they can pay for, and interest costs and monthly payments are very clearly spelled out to shoppers before they transact so they can make an educated decision whether to pay using Affirm.

“Almost immediately we did a very nice amount of business through Affirm,” says Karnowsky. “We were a bit surprised, honestly. They told us what to expect. But we didn’t really think people would adopt it quite so quickly.”

Due to the positive results they were already seeing, Jomashop decided to further leverage Affirm as a performance marketing tool further up the purchase funnel via off-site marketing. They co-branded display retargeting ads with Affirm’s “as low as” messaging and tested them against ads without Affirm. The results were better than expected — those with Affirm’s messaging saw 67% lift in return on ad spend (ROAS). “This clearly shows the power of Affirm as a marketing tool beyond being just another payment option,” said Karnowsky. “The results were very encouraging and we look forward to further integrating Affirm into our off-site marketing efforts.” It was a clear indication that customers were more likely to engage with ads that communicated the ability to pay-over-time.

“Affirm is making more and more customers feel comfortable about buying something that has a higher price tag. It’s just common sense. If you can afford $500 up front, and you have the option to spread payments over time, you’re more likely to push that limit even more. It’s good for our business, but even better for our customers because they’re getting something they love that they wouldn’t have been able to obtain in the past. And all in a responsible way.”