GhostBed returned from Klarna to access more customers

“GhostBed is really the end result of the evolution of who I am,” Marc Werner, CEO of GhostBed said.

Werner is part of a long family history of inventing and manufacturing. His grandfather and then his father ran Werner Co., a name synonymous with the ladder business. His father invented the first aluminum and fiberglass ladders, and Werner grew up running around factories and polymer laboratories.

With his family’s history in manufacturing, he knew he wanted to run his own business. But it wasn’t until discovering memory foam—15 years before it became a household name—because of his struggles finding a comfortable mattress after multiple neck surgeries, did Werner get excited about breaking into the mattress industry.

“I liked the fact that we could compress this [memory foam] mattress into a small, little box to make it easier for shipping, warehousing, and storage,” he said. “Coming from the ladder business, I’m always used to shipping air. You can't get many dollars worth of 40-foot extension ladders on a truck.”

Werner’s goal for GhostBed is four, simple words; bigger, better, less expensive. His company has over 15,000 positive customer reviews and is recommended by Consumer Reports, a fact he is extremely proud of.

Affirm was the digital solution GhostBed needed to make its business thrive

Werner knew that the bulk of mattresses are sold on credit in the brick and mortar world. He needed a digital solution that would provide the same service to his e-commerce customers, something the credit solution he was familiar with, Synchrony, couldn’t provide.

“My family’s business philosophy is ‘make it easy for your customer to do business with you,’” he said. “I try to take that statement as far as I can.”

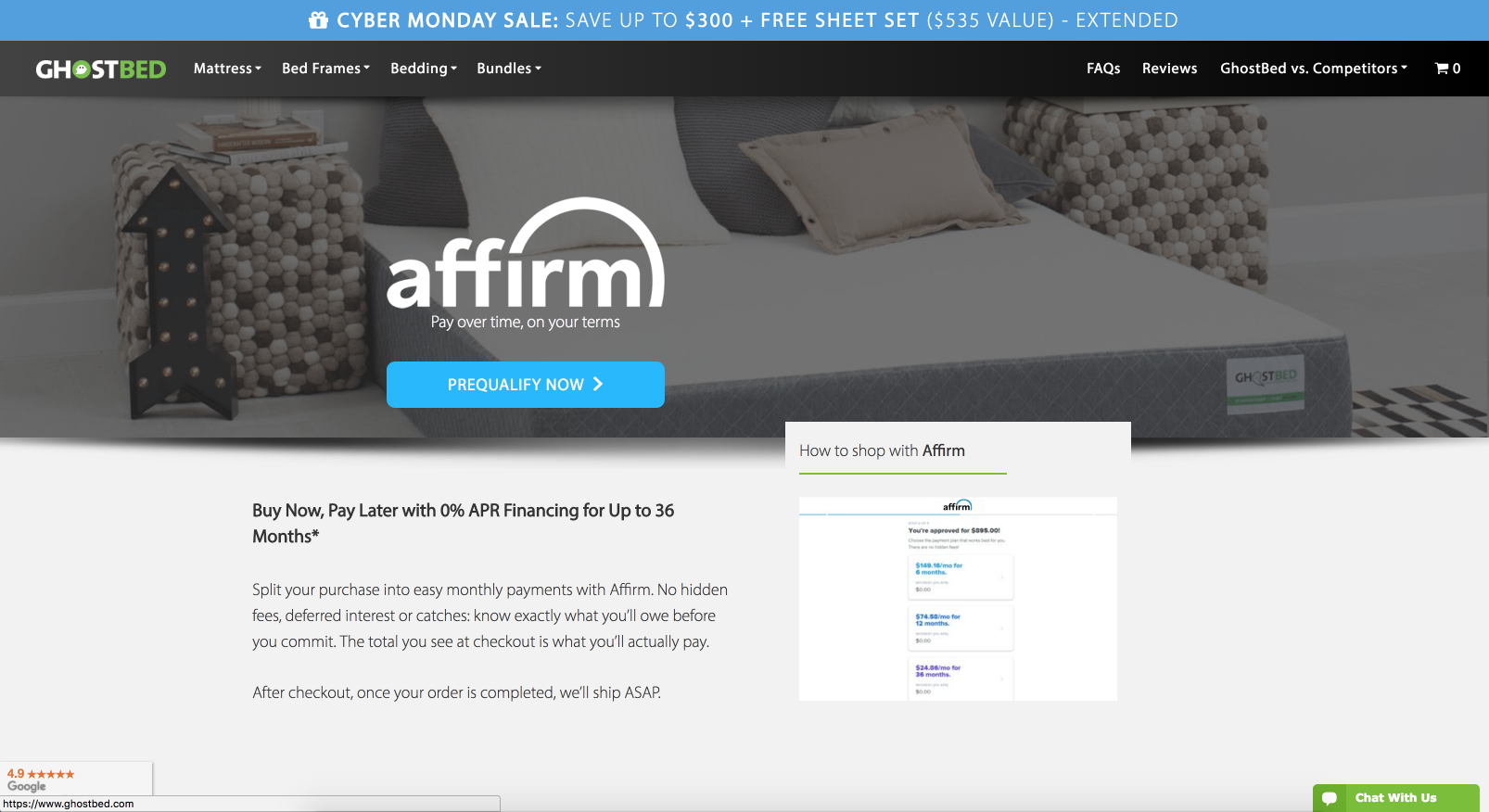

Affirm’s digital-first pay-over-time solution fulfilled Werner’s needs, including a WooCommerce plugin and options for increased approvals and 0% APR promotions. Affirm also helped Werner offer something his competitors didn’t, the ability to stack multiple deals on one order—i.e., 0 percent interest plus a discount.

GhostBed was one of Affirm’s first partners to take advantage of our increased approvals program. This program allows our merchants to pay a higher rate to cover the increased risk to Affirm when approving deeper credit levels, leading to more customers for their business.

During this period, Klarna approached Werner and convinced him that they could provide the same approval rates as Affirm with a substantially cheaper price tag, leading to significant savings. Under these pretenses, Werner decided, for economic reasons, he needed to make the switch to Klarna.

Klarna didn’t measure up

However, the truth with Klarna was a different story.

“The approval rates were not what Klarna represented,” Werner said. “Although their cost was much less, their approval rates were ridiculously low. I realized that they didn’t have what they were initially representing. The increased approvals program we had with Affirm was a completely different thing. We got about 30-40 percent more approvals with Affirm.”

This decrease in approvals from Klarna wasn’t only impacting GhostBed’s bottom line, but also their relationships with customers. With more customer’s denied credit through Klarna, they were understandably upset with GhostBed.

“We're not the financing people, we're just the mattress people,” Werner said. “But we absolutely become the whipping boy as soon as they're not approved and they are unhappy. It's my fault no matter who we finance with. We take responsibility.”

Affirm’s higher approvals with price optimization brought back GhostBed

During GhostBed’s time with Klarna, Affirm had developed more sophisticated pricing optimization programs in addition to our increased approvals feature. We also were working to upgrade and expand our suite of programs. We reached back out to Werner to explain these new features and pricing. We explained how our programs were different than Klarna’s, and how we’re able to provide more cost-effective approvals than before.

Werner decided that GhostBed couldn’t operate effectively at the low approval rates from Klarna. But there were other reasons he wanted to come back to Affirm.

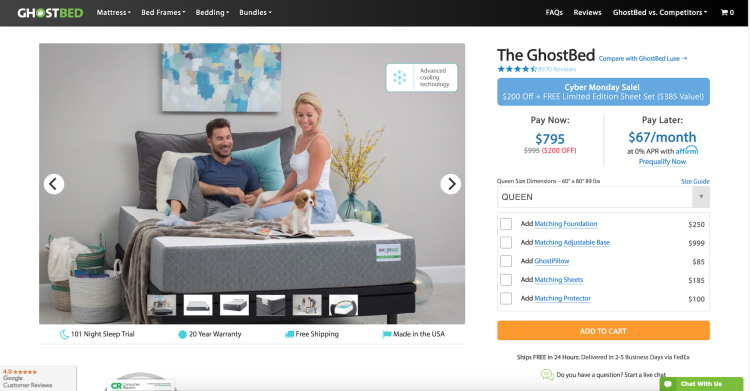

“Klarna also had a problem underwriting bigger ticket loans,” Werner said. “Affirm was comfortable underwriting $4,000 or $5,000 and that was important to me because the mattress space was getting more competitive and my product line was changing. Because of additional products and higher value products, the average ticket was being driven up, so I needed my financing team to provide enough credit for those customers.”

Once Werner heard about Affirm’s new features like longer terms and prequalify, he was sold.

“I discussed it with my CFO. We decided we would go back to Affirm because we always thought they were great and had now addressed our main issue and done more,” he said.

Affirm’s programs make a lasting impact on GhostBed

Now, GhostBed is taking advantage of all Affirm has to offer. They use “as low as” and prequalification messaging onsite to encourage customers to bundle items together and advertise 0% APR promotions over email and social campaigns. And with longer terms up to 36 months, GhostBed can decrease the monthly burden on customers.

With prequalification, zero interest, longer terms, and the higher credit limit, GhostBed is encouraging their shoppers to checkout with a higher than industry average order value.

“On our reviews, I see pretty consistently that people say if it wasn't for the nice, easy financing, they couldn’t have gotten a GhostBed product,” Werner said.

Werner and GhostBed left the Affirm family hoping for a cheaper alternative with the same results. But it didn’t take long for them to realize Affirm offers a service that is substantially better than any alternative.